I am a member of the Collective Bias Social Fabric® Community. Collective Bias has provided me with compensation for my time and effort to evaluate this website. Participation in this program is voluntary. As always, all opinions are 100% my own.

I love a good deal. Don’t you? I’m always looking for ways I can cut our bills. One thing I check regularly is our car insurance. I’ve switched carriers on a couple of occasions when I found a significant price difference.

There’s so many ways you can save when buying car insurance. I’ve put together a list of my TOP TEN ways I have knocked money off my premiums to get that best deal.

1. Find out about the discounts you qualify for AND check them over time because you might qualify for additional discounts as things change over time. Here are some examples of discounts:

- Defensive driving courses – they even have them online

- Low annual mileage – less driving means lower premiums

- Anti-theft devices – from car alarms to VIN etching on the windows

- Customer loyalty – staying with the same insurance company

- Organizations or Corporate discount – does your company offer a deal with a certain insurance company?

2. Multiple policies. Bundle your homeowner’s insurance or renter’s insurance along with your car insurance for significant savings for both.

3. Review your insurance policy regularly. Allow your policy to reflect your lifestyle. Otherwise, you could be paying for unnecessary coverage on your policy such as collision repair on an older car.

4. Drop unnecessary coverage. If you state doesn’t require uninsured motorist coverage, then consider dropping it to lessen your cost.

5. Raise your deductible. This will significantly lower your car insurance premiums. Someone with a $250 deductible will pay significantly more per month than someone with $1000 deductible.

6. Keep good credit! Credit-based insurance scoring is a big factor in the cost of your premiums. Likewise, how you spend money says a lot about how responsible you are. Depending on the state, insurance companies could look to your credit score when determining if you are likely to be a safe or more reckless driver.

7. Before you buy a car, know the cost of insuring it. Some cars cost more to insure due to repair costs, theft, etc.

8. Keep a good driving record. Accidents and moving violations will increase the cost of your premiums.

9. Move to the suburbs! Living in a suburban or rural area is cheaper than an urban area due to higher rates of vandalism, theft, and accidents.

10. Get at least THREE Quotes. Try to get at least three identical quotes for the exact same coverage from different insurance companies.

Searching and switching can be such a big pain! In the past, I would go to each carrier’s website and go through a long process to get a quote for each company. It took a lot of time, but now there’s a new way to save!

AutoInsurance.com is the first independently operated site that quickly and easily searches, compares, and allows users to purchase auto insurance. It can save you time and money. You can even retrieve your current auto insurance policy information and compare it “apples-to-apples” with the quotes offered.

Currently Autoinsurance.com is only available to those who live in Texas, Arkansas, Oklahoma, Missouri, Louisiana, Tennessee, or Mississippi, and they can compare quotes from up to six top national carriers — all at once!

- Progressive

- Travelers

- Esurance

- 21st Century

- The General

- Safeco

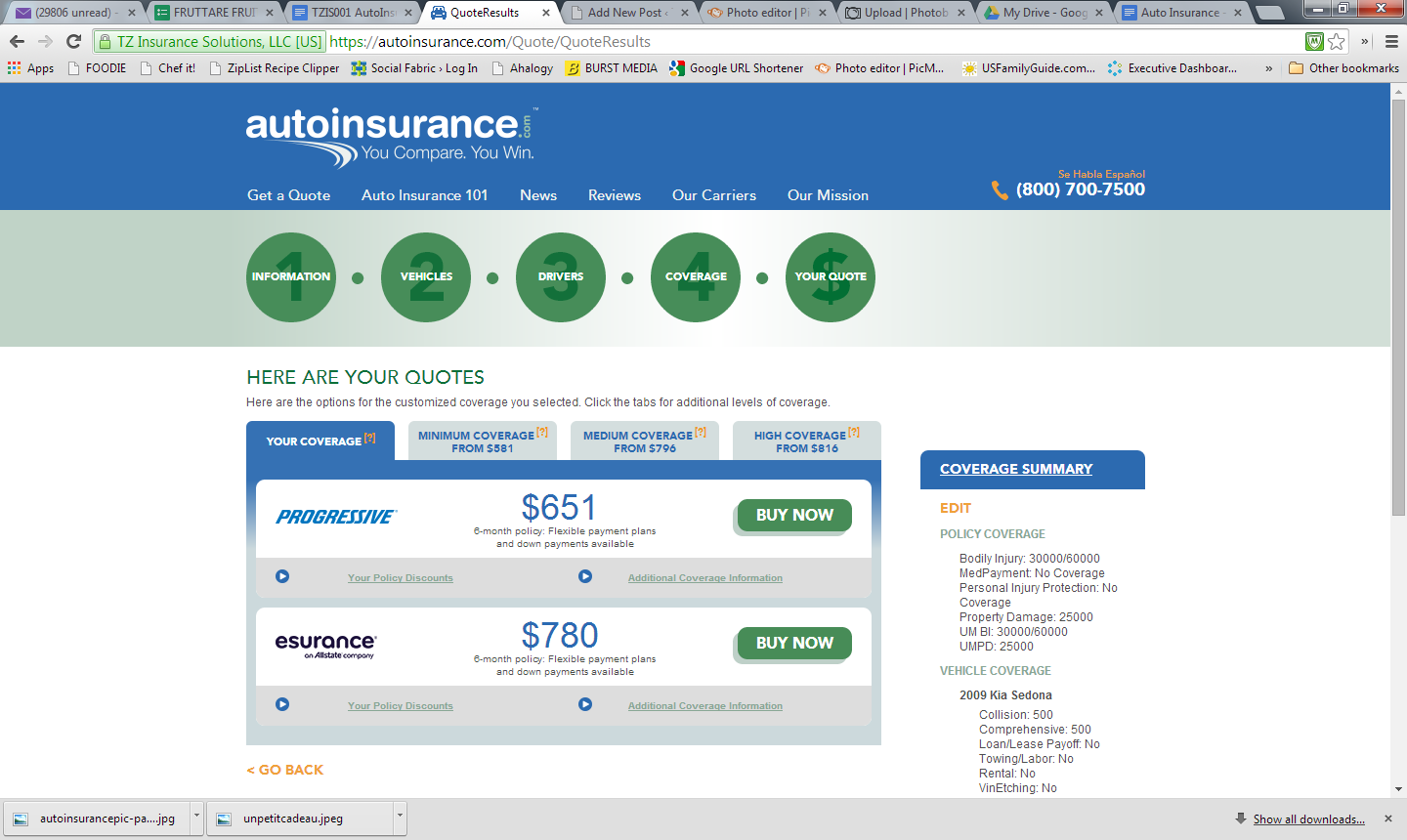

This was so much easier than going to different insurance company websites. It took me less than 10 minutes to get multiple quotes identical to my current policy to easily compare prices. Not only does it show you identical coverage, it also shows you prices for less and more coverage, so you can easily choose.

Often times when you check quotes online, they are just estimates, With AutoInsurance.com, I got real-time quotes directly from the carriers, and these policies could be purchased directly through the site or via phone with one of their licensed agents.

This is changing shopping for car insurance for the better!

To find out more or keep up to date on new states being added, check out their Facebook and Twitter pages.

How do you save money on car insurance?

#Compare2Win #CollectiveBias

2 comments

We have our homeowners and car insurance with the same insurer, which gives us a discount. This was great information, thank you!

I should consider lowering some of my coverage to save money since my car is paid in full…but I’m scared! 🙂

#client